As any single parent will know, trying to make your money stretch for the whole month can be quite the challenge. Many of us try our best to strike a healthy balance between saving and treating ourselves and our kids to the odd treat here and there. But when even your more tactful financial measures aren’t going to plan, what do you do? Having to tell your kids that there will be no summer holiday this year, or having to swap your creative, healthy meals for plain, basic food can be gut-wrenching – after all, you work to provide for your kids. When you can no longer do this, it can sometimes start to feel as though you have failed as a parent. This is far from the truth, though. Nearly everyone struggles with the costs that everyday life can throw at us. Sure, we are earning more now than our parents were back in the 60s and 70s. But along with that wage increase, the cost of living has gone up as well. Everything from bread to bills can eat a hole in your pocket unless you’re super savvy. If saving money is on your agenda, the first things to go will usually be treats, such as trips away and luxuries like Netflix. But did you know that you might not have to sacrifice these things at all? You could be paying more than you need to for certain everyday conveniences that you haven’t ever looked into before – here are some examples and what you can do to cut back on that spending.

Image source

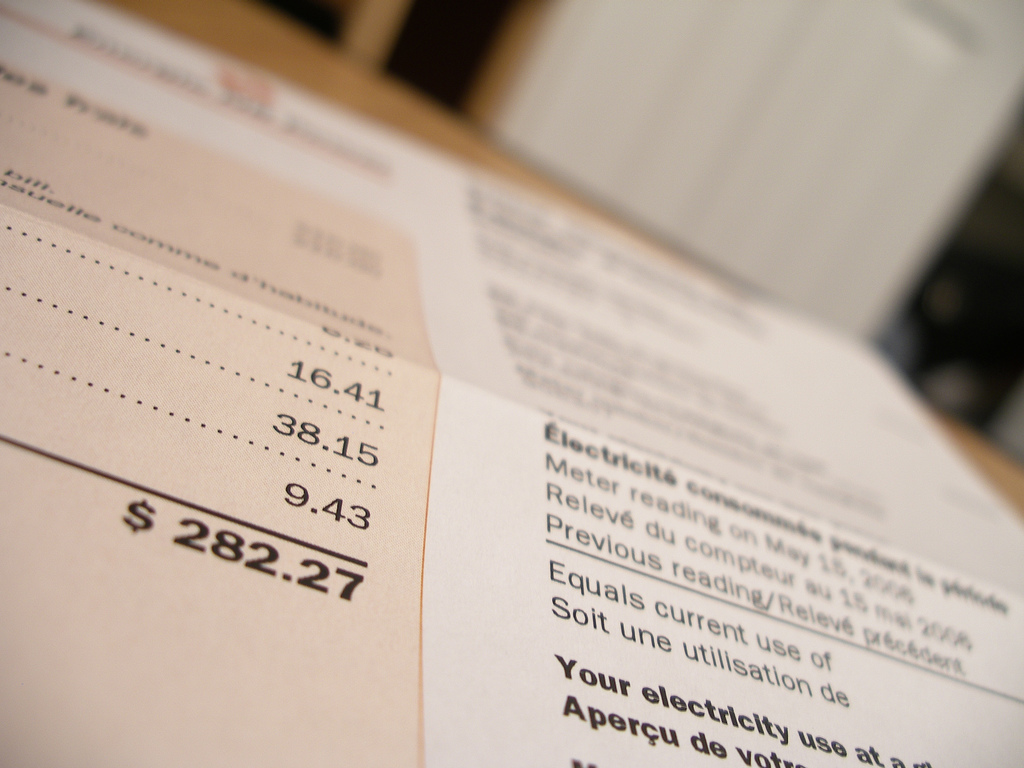

Household bills

If there’s one thing we all dread, it’s the household bills coming through the door every month. You might think you have been totally frugal one month only to find that you are no longer in credit with your chosen company, and no one likes that nasty surprise! Thankfully, there are a few things you can do to cut the cost of your energy bills. One example is considering changing your provider. Yes, it can be a hassle – but wouldn’t we all take savings of hundreds of pounds over a day or two of hassle? Websites such as simplyswitch.com help you to compare all the market leaders in energy supply so you can see what the best deal is for your home. There are also a few things you can do within your house itself to end the month with a smaller energy payout. Got a leaky tap? Get it fixed – it could save you more than you think. If you are doing DIY and needing to buy tools always go for the best your money can buy and that are rated by other people. Honestly, it saves you money in the long run if you check out places like Contractor Culture first. Plus, make a point of turning off all your electronic devices once you or your children have finished playing with them, as they still use up vital energy if they are still plugged into the mains.

Image source

Rent

If you are one of the millions of families across the UK who rent their property rather than buy, you will know just how expensive rent can be. Of course, once you’re signed into a contract there isn’t a great deal you can do about the rent you pay. But it can be worth haggling all the same. For example, if you agree to sign a two-year contract rather than your usual six months, try and persuade your landlord to give you some money off as a result. Or, if you have a feeling you are being ripped off, do some research on the other rental prices in your area for a property the same as yours, and present the information to your estate agents. If they can’t explain why your rent is so much higher, you could be able to lessen the price.

Image source

Car

Having a car is incredibly practical for busy, single mums. It also allows us to give our children a better quality of life, as we can easily take them on days out and adventures without having to worry about catching the last bus home. But they are also money-guzzling machines that can cost us thousands of pounds every single year. Getting rid of your car isn’t an option for many of us, but there are a few ways you can save money on its maintenance and how it runs. Firstly, make sure you change your car’s oil and oil filter every 3000 miles or so, despite what your owner’s manual may tell you. By keeping on top of this, your car can run much more economically, and it’s easy to do yourself, as well. Also make a point of checking your tire pressure regularly, as under-inflated tires can result in 6% petrol wastage on every journey you make. Finally, think about how you use your car. If you let the engine run in a morning while your kids retrieve the last few schoolbooks from the house, stop! This alone could cost you a lot of money in petrol – providing it’s not an ice-cold day; the engine should warm up just fine once you start moving.

Image source

Groceries

Most UK families spend just under £60 a week on food. How do you compare against this figure? This might sound pretty reasonable for a family of three or four, but let’s be honest: how many of us are guilty of doing ‘top up’ shops throughout the week? If your shopping bill is burning a hole in your wallet, you’re going to want to listen to these tips on how to slash your grocery spend in half. Number one has to start shopping at local markets – the produce is cheaper and often of a better quality too. Consider removing meat and fish from your diet, or at least cutting down on the amount you consume as a family. Meat and fish make up around a quarter of every weekly food bill, so you could save a lot of money. Planning your meals in advance and opting for supermarket’s own instead of big brands are also some easy ways to save your pennies for something more desirable – who knows, that family holiday of a lifetime could be closer than you think!

Leave a Reply